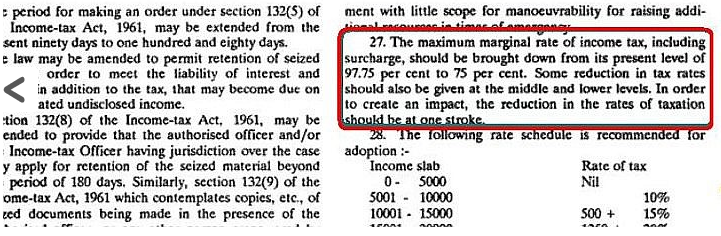

Imagine the world where you end up paying 4-5 different taxes while purchasing any good for your use. Well, put a break on your imagination because you are actually doing the same right now. In India, we have several types of Indirect & Direct taxes. Though we only think Income tax as a tax which is affecting our mundane life but unfortunately at some point of time we actually pay some taxes indirectly like VAT, CST, and Excise etc. to purchase our products. Just to give you a brief impact of taxes in your life just flash back to Indira Gandhi era when she actually raised income tax to 97.5% of your total income and we still blame brain drain as a major problem in India!

In the year 2000, Indian government created a panel to design a panel for GST (Goods and Service Tax). Even though the committee didn’t excel in bringing an earlier model of GST but they came up with VAT (Value Added Tax) structure in the year 2005 which was actually a big relief to the industry after the draconian Sales TAX rules. Finally in the year 2015 bill got passed in parliament and government has decided to implement GST in 2017 only.

Well first we need to try to understand what is GST and why is it even necessary.

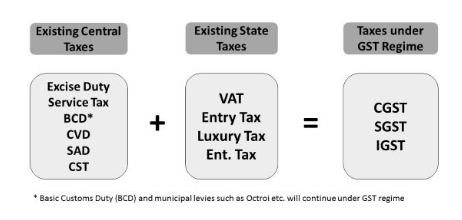

GST is a concept to bring all the indirect taxes into one tax. It means Goods and Service Tax. May be this concept is new to India but many countries are actually following it since ages. GST is the solution to control the web of various indirect taxes. Let see what indirect taxes are and why it was actually a problem.

Indirect Taxes are broadly those taxes which we as a consumer don’t pay directly. As on today we have 6 major indirect taxes in India

- Excise Duty on Manufacturing ( It is a Central Tax)

- Value Added Tax (VAT) on within the state sale of goods (It is a State government Tax)

- Central State Tax (CST) on sale of goods from one state to another ( It is a Central Tax)

- Service tax on avail of any services ( Central Tax)

- Custom duties in import of any product from any other nation ( Central Tax)

- Octroi or entry tax on entry of a good in particular areas of India ( State Government Tax)

GST on its implementation will replace all these taxes and we will have only one tax structure.

Benefits of GST over Previous Indirect Taxes: GST is probably the 1st tax structure which is written in a way to give benefit to both the industries and end consumers.

Consumers: If we calculate the impact of all the above-mentioned taxes then we were at least paying 30~33% of the total amount as a TAX only. You must be wondering that you paid only 5% or 12.5 % of VAT in the bill? Well, it is not true. Earlier TAX structure was so complicated and it was a destination based tax which means Tax is levied on consumption of goods and service as well as collected at the place where such consumption is taking place. Due to this concept, we actually end up paying 12.5% of excise, state VAT of 5~20% (depends on state and commodity) and various other taxes like octroi, local entry tax and what not.

GST basically is a destination based tax and having a flat tax structure across the level. Hence in a long term, the cost benefit will be passed on to him. As of now decided GST taxes are 5%, 12%, and 18% which depends on the commodity. At present, under the constitution, the Union government is constrained from charging taxes on goods beyond the process of manufacturing. State governments cannot charge taxes on services. So, to streamline the existing indirect tax structure, an amendment to existing constitution is necessary. Implementing an integrated GST through constitutional amendment can change the existing indirect tax system.

Industries: Industries will get lots of benefits. Suppose a company has 3 different registered offices in Delhi, Haryana & Uttar Pradesh, then the company might be dealing with up to 18 different taxes. Also, the company will be liable to file different returns as per the state government and central government norms. Please check the below table to see the tax structure of various states.

| State | State Govt Taxes ( VAT) | Central Taxes | Forms Include |

|---|---|---|---|

| Delhi | 5%, 12.5%, 18% | Excise: 12.5% CST : 5%, 12.5%, 18% | DS2 to bring material in to Delhi from other state. |

| Haryana | 5%, 12.5%, 14% and 5% as a surcharge | Excise: 12.5%, CST: 5%, 12.5%, 18% & 5% additional as a surcharge | Form D1 & form C4 to reduce the impact of VAT within the state. |

| UP | 5%, 12.5%, 20% and additional 2% VAT on every commodity | Excise : 12.5%, CST: 5%, 12.5% 20% and additional 2% VAT on every commodity. | Form 38 to bring material in from some other state. |

Under GST, The concept of origin-based taxation will be replaced by consumption based taxations ( with exceptions). GST is expected to be levied at the place of consumption. Hence the tax revenue would shift to the consumption states rather than the origin states.

There will be no overlapping of taxes. If a product is manufactured and sold to a customer, there will be a single indirect tax. If the GST rate is 15% and product is sold for Rs 300, then GST charged would be Rs 45. The total GST paid by manufacturer, distributor and retailer will never be more than Rs 45. Out of Rs 45, each of them will pay their part of GST.

Areas of ambiguity which need to be addressed by GST law

- Due date of payment of service tax liability which needs to be paid on 6th of next month. VAT laws of some states offer a minimum of a minimum 20 days for calculating taxes and payment. The drafted GST law also prescribes 20th of next month for tax payment. Therefore, there is a need for aligning the payment date prescribed by GST.

- There has been low limit stated in law for adjudication, needless ambiguity and confusion has been created leading to overdue litigation which have an adverse impact on the business. Rectifying them in the upcoming budget will minimize the carry forward of past litigation in GST regime.

- At present, only a specific category of people can apply for advance ruling. Advance ruling is a mechanism for planning tax affairs in advance for avoiding long drawn & costly litigation. The proposed GST law will allow everyone impartially to apply for advance ruling. Its introduction in the budget will boost the confidence of investors. They will be able to take informed decisions.

In the conclusion, GST is probably the only big reform in tax structure since Independence and it will give a financial independence to industries. GST reform is the most awaited reform since 1991 to make India as a favorable nation to do business.